Medicaid Eligibility and Planning Information

New York has substantially changed the Medicaid provisions that apply in a situation where one spouse is institutionalized and the other spouse remains at home. These rules were designed to prevent spousal impoverishment.

For the purpose of simplicity, I will refer to the spouse who enters the nursing home as the Institutionalized Spouse and the spouse who remains in their home as the Community Spouse.

For 2019, if you move to a nursing home, your spouse (the Community Spouse) may keep the home, one car, and other assets totaling $74,820 (in some very special cases the spouse can keep $125,420) and can prepay burials and buy cemetery plots for both spouses and their children. The community spouse can also retain $3,160.50 in monthly income, and you as the Institutionalized Spouse will still qualify for Medicaid to pay your Nursing Home expenses. It is immaterial that the monthly income may come from the institutionalized spouse’s Social Security or pension – all income is combined and totaled to arrive at these numbers.

In addition to these sums, the Institutionalized Spouse is allowed to keep $50 per month of income to cover personal needs and a bank account of $15,450. For a person applying for Medicaid who does not have a spouse, these numbers remain the same – $50 per month income allowance and $15,150 in assets. An irrevocable burial account and a cemetery plot are also allowed. A life insurance policy with a death benefit of $1,500 is also allowed.

When assessing eligibility for benefits, Medicaid looks back at the applicant’s financial history for the previous 60 months. Therefore, any gifts or transfers made within this time period will be looked at to determine if a period of restricted coverage will be imposed. Please note that deeds transferring property for $1.00 are considered gifts.

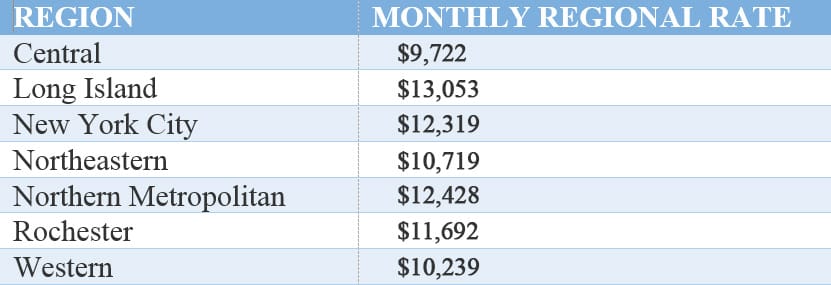

The total of all gifts made during that previous 60 month period will be divided by a number which represents Medicaid’s average monthly cost of Nursing Home care in your area. Currently these numbers are:

Medicaid divides the amount of the gift by that number, and the number reached is the number of months that the individual will be INELIGIBLE to receive Medicaid. Example—you give away $102,390.00 on January 1, 2016; if you applied now; you would be ineligible for the first 10 months commencing on the date of application, not the date of the transfer.

As you can see, transfers can have very harsh consequences and you should not make any without the benefit of counsel. This area of the law is very complex and constantly changing.

Medicare (not to be confused with Medicaid) is the government health insurance program for persons over the age of 65 years or who are permanently disabled, will cover up to 100 days of care needed in a “skilled” nursing home after release from hospitalization, with a co-pay requirement for the last 80 days of that period. Very few people qualify for “skilled” nursing care which is a covered Medicare benefit. Veterans’ benefits often will pay for skilled nursing care and should be investigated if the applicant is a Veteran.

The following are some questions we often hear. The answers should help to give you some guidance. It is essential that you consult with an attorney before making any gifts or transfers, as there are certain exceptions which may assist in your particular situation.

YOU AND NURSING HOME COSTS

1. Q. WILL MEDICARE PAY FOR MY NURSING HOME COSTS?

A. No. Medicare (Part A) provides only for a maximum of 100 days in a skilled nursing facility. Most nursing home patients do not require or qualify for skilled nursing care.

Medicare does not provide protection for the expenses of long-term health care such as (1) custodial nursing home care; (2) adult day care; or (3) home care provided by relatives or employed caretakers.

2. Q. WHAT GOVERNMENT PROGRAM WILL PAY FOR MY NURSING HOME COST?

A. The only government program that will pay for long-term care is Medicaid, which is a jointly financed federal and state medical welfare program for the poor. The Medicaid program in New York is administered by the New York Department of Social Services.

3. Q. HOW CAN I PROTECT MY ASSETS FROM BEING CONSUMED BY NURSING HOME COSTS?

A. The strategy most frequently used to protect and save the senior’s assets is called the “impoverishment” or “planned poverty” strategy. Simply stated, the senior gives away all or nearly all of his or her assets for the purpose of qualifying for Medicaid. The assets are transferred at such time, and in such manner, as to put them beyond the reach of the Medicaid program. The other way is to obtain a long term care insurance policy.

4. Q. WHAT ASSETS CAN I KEEP AND STILL BE ELIGIBLE FOR MEDICAID COVERAGE OF NURSING HOME COSTS?

A. If you are married and only one spouse needs nursing home care, the spouse remaining home (known as the “community spouse”) can keep the house (if worth less than $878,000), personal property, car, burial funds and up to $74,820 in cash, deposits and/or stock.

If you are single, you are limited to $15,450 plus a burial fund of up to $1,500 and an irrevocable burial trust and a cemetery plot or niche. You also may own a life insurance policy with a death benefit of $1,500.

Assets in excess of the above limits would have to be applied to the cost of care (known as “spending down”) before Medicaid begins coverage.

5. Q. WHAT INCOME CAN I KEEP AND STILL BE ELIGIBLE FOR MEDICAID COVERAGE OF NURSING HOME COSTS?

A. If you are married, the community spouse can retain up to $3,160.50 in monthly income. Some portion of monthly income in excess of $3,160.50 may have to be applied to the “institutionalized” spouse’s cost of care. The term “income” includes Social Security Retirement, pension, interest, dividends, rental income, IRA distributions and the like.

If you are single, all but $50 of your monthly income will be required to be applied to the cost of your care. The $50 is your “personal needs allowance” to be spent as you see fit.

6. Q. WHAT IF I TRANSFER MY ASSETS TO MY CHILDREN JUST BEFORE I GO INTO A NURSING HOME?

A. Under the Sixty Month Rule (applicable to outright transfers or transfers to a trust) eligibility for Medicaid is denied for a period of time if the person going into the nursing home transferred assets for less than fair market value within sixty months before his application for Medicaid benefits.

The period of ineligibility begins with the month after application for Medicaid and will last for the number of months equal to the total value of the transferred property divided by the monthly cost of nursing home care in your region.

7. Q. WHAT CAN BE DONE IF THE SENIOR IS ALREADY IN A NURSING HOME?

A. The options available in this scenario are very limited. You need to contact your attorney immediately.

8. Q. I HEAR A LOT ABOUT “LIVING TRUSTS.” CAN SUCH A TRUST PROTECT MY ASSETS?

A. Not likely. There are two types of trust that you can establish while alive (“living trusts”): revocable and irrevocable. A revocable trust is one that you can always make changes to and even revoke at will. For Medicaid purposes, this trust affords no protection.

The irrevocable trust can provide asset protection. However, as the name implies, once created it cannot be altered or revoked. Therefore, any assets you put in an irrevocable trust will never again be “yours” or subject to your control. Also, a transfer of assets to an irrevocable trust extends the “look back period” by invoking the Sixty Month Rule (see, #6 above). Unless you have a significant amount of money that you will never miss losing control of, an irrevocable trust is not a viable option.

9. Q. IF I SET UP AN IRREVOCABLE TRUST, CAN I HAVE ACCESS TO THE PRINCIPAL AND/OR INCOME?

A. The Trustee must not be given discretion to distribute principal to the grantor Medicaid applicant: If the Trustee has the discretion to distribute income, then all income will be available for Nursing Home care, but the principal would be protected.

a) Under prior law, Section 1902 of the Social Security Act and corresponding state law regulations provide that for purposes of meeting the Medicaid eligibility requirements, the maximum amount which could be distributed from a trust to its grantor under the terms of the trust, assuming full exercise of discretion by the Trustees, will be considered available as a resource to the grantor regardless of whether:

1. The discretion is actually exercised;

2. The trust is irrevocable;

3. The trust is established for purposes of permitting the grantor to qualify for Medicaid assistance.

b) Under recent federal legislation (DRA 2005), if you have access to the principal of a trust, it is considered a resource and, therefore, available to pay the cost of your care.

c) Please note that Estate, Powers and Trusts Law 7-3.1 and decisions of New York State courts similarly prohibit access to principal.

d) The trust must be drafted to preclude statutory authority (EPTL 7-1.6(b)) for invasion of corpus for your benefit. This is possible, though, for trusts created by your Will (known as “testamentary trusts”).

10. Q. HOW CAN I PROTECT MY HOUSE?

A. Transfer of residence – if the Medicaid applicant is married, he or she may retain a principal residence in which a spouse resides. The house is exempt property regardless of value. However, if the applicant does not have a spouse or the spouse dies, the house may (1) no longer be exempt property, (2) may be subject to nursing home costs, and (3) may preclude Medicaid qualification.

A transfer of the residence to the children with the parent preserving a life estate is sometimes advisable. Although the value of the life estate might still be at risk during the applicant’s life, there are certain planning possibilities available to protect the life estate.

Note: The retained life estate as stated under Section 2036 of the Internal Revenue Code insures that the full value of the home will be includable in the parent’s estate to insure “stepped-up” basis on the parent’s death which enables the children to sell the house free of capital gains tax on the parent’s death.

11. Q. IS TRANSFERRING ASSETS A WISE THING TO DO?

A. It depends. The most important reason not to transfer assets is that once you give an asset away it is no longer yours. If you have a great deal of assets, giving away a portion may not be a problem. But, for most people, transferring assets usually means giving money to children who will “certainly” give it back to you later if you really need it.

Unfortunately, life does not often unfold according to one’s expectations. For example, children can get married, divorced, die, be sued, go bankrupt, or become estranged. Any of these events can diminish, if not entirely eliminate, any chance of getting your money back.

Also, seeking nursing home care as a Medicaid patient – as opposed to a “private pay” patient converted to Medicaid – offers far fewer choices. For example, Social Services has a “fifty mile rule” which allows for placement in any available facility within a 50 mile radius of the patient’s home.

Remember, the $15,000 gift tax exemption set by the IRS is for tax imposed on gifts you make – it has nothing to do with Medicaid gifts. Medicaid does not allow any gifts during the 60 month period before you apply for Medicaid benefits, even if the IRS does. Do not confuse them.

12. Q. ARE THERE ANY OTHER WAYS TO PROTECT MY ASSETS?

A. Yes. Nursing home or long-term care insurance is available from several major insurance companies. The cost for this insurance varies according to the age and health of the applicant. In New York – one of the four participating states – the insured under a certified policy can establish Medicaid eligibility at the expiration of the policy benefit period (usually 36 months) and shelter an unlimited amount of assets while receiving Medicaid benefits. However, the insured’s income, beyond the limits outlined above, must be applied toward the costs of care.

PLEASE NOTE THAT THIS DOCUMENT IS NOT MEANT TO GIVE LEGAL ADVICE SPECIFIC TO YOUR SITUATION, BUT ONLY TO GENERAL ANSWERS TO FREQUENTLY ASKED QUESTIONS ABOUT PROTECTING ASSETS FROM NURSING HOME COSTS.

THE INFORMATION CONTAINED HEREIN IS SPECIFIC FOR RESIDENTS OF NEW YORK STATE ONLY.

IF YOU WANT ADVICE SPECIFIC TO YOUR SITUATION, YOU SHOULD SCHEDULE AN APPOINTMENT TO MEET WITH ONE OF OUR ATTORNEYS. THERE ARE ALMOST ALWAYS VERY SIGNIFICANT ESTATE TAX, GIFT TAX, INCOME TAX, AND FINANCIAL AND ESTATE PLANNING RAMIFICATIONS THAT MUST BE REVIEWED BEFORE TRANSFERRING ANY ASSET.

Attorneys Who Practice in this Area

How can we help? Contact us

Testimonial

Thank you for your excellent service. We appreciated your patience and expertise as we worked through the important process of formulating a will and other related matters. It’s great to have you “on our side”